Bill factoring, also called accounts receivable factoring, is a type of financing that converts outstanding invoices into quick money in your small enterprise. The other celebration concerned on this transaction is called an element or factoring firm. For example, a mid-sized manufacturing company carried out an AR automation software that built-in with their current CRM and accounting software. The outcome was a 25% discount of their average assortment period within the first six months.

Consider offering flexibility in payment phrases where potential – for example, underneath special circumstances the place cost throughout the traditional assortment interval is inconceivable. Demonstrating understanding and suppleness in these situations is not simply ethically sound, however it can additionally immediate increased customer loyalty and optimistic word-of-mouth. The assumption behind a credit score sale is that the customer will honour the settlement and pay at a future date. The ability to deliver money in at a quicker tempo can create a extra environment friendly business operation. It supplies the company with improved liquidity, thereby enhancing the company’s monetary flexibility and solvency. This ratio is very important for administration to evaluate the gathering performance in addition to credit gross sales assessments.

The account receivable assortment period measures the common number of days that credit score receivables collection period prospects normally make the cost to the corporate. The accounts receivable collection interval someday called the day’s gross sales outstanding simply means the interval (number of days) by which credit gross sales are collected from clients. Monitoring the typical settlement interval is akin to taking the monetary pulse of a business.

Limitation Of Account Receivable Assortment Period

- Every success story serves as a testomony to the potential positive aspects from prioritizing and innovating in accounts receivable administration.

- Your common assortment period tells you the number of accounts receivable days it takes after a credit sale to obtain cost.

- Nonetheless, within the final two years, it rose once more to 31 days in 2024 and 37 days in 2025.

- Average Assortment Interval is an important metric that gives perception into your company’s capacity to convert credit gross sales into money, impacting everything from liquidity to credit coverage.

This metric, often referred to as days Gross Sales excellent (DSO), represents the typical variety of days it takes for an organization to collect cost after a sale has been made. A lower DSO indicates that an organization is ready to shortly collect on its receivables, which can result in improved money move and reduced interest expenses. Conversely, the next DSO can signal potential points within the assortment process, similar to inefficiencies or customer dissatisfaction. Corporations depend on their common collection interval to know how effectively they’re managing money move and whether or not they should change their collections processes. A shorter average assortment interval informs an organization that it’s amassing buyer payments quicker after a sale.

Why Is The Accounts Receivable Collection Interval Important?

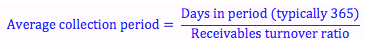

In the realm of accounts receivable, the collection interval is a critical metric that serves as a barometer for a corporation’s monetary health and operational effectivity. This period, typically measured in days, represents the average time it takes for a enterprise to convert its credit sales into money. A shorter assortment period signifies a swift turnover, which may lead to improved cash circulate and lowered danger of dangerous money owed. Conversely, a protracted assortment period might sign potential cash flow issues, necessitating a more in-depth examination of credit insurance policies and buyer cost behaviors. The average assortment interval ratio is a measure of the time it usually takes a business to receive funds owed by its customers. It’s calculated by dividing the average accounts receivable by the whole internet credit gross sales after which multiplying the result by the entire number of days in the period.

Understanding The Fundamentals Before Calculating

Businesses must be in a position to manage their average assortment period to operate smoothly. Accounts receivable (AR) is a enterprise term used to describe cash that entities owe to an organization once they buy goods and/or companies. AR is listed on corporations’ stability sheets as current assets and measures their liquidity. As such, they point out their capability to repay their short-term money owed with out the want to depend on more money flows.

What Is A Good Common Collection Period?

Frequently evaluating these metrics enables corporations to pinpoint operational strengths and weaknesses. Shortening the receivable assortment interval and decreasing days to collect which might https://www.kelleysbookkeeping.com/ significantly enhance liquidity, permitting faster reinvestment into growth initiatives or debt repayment. Additionally, analyzing developments over time can help make informed strategic selections, similar to revising credit terms or enhancing collections processes. Ultimately, monitoring these metrics fosters proactive administration of money circulate, making certain healthier financial operations and stronger competitive positioning within the marketplace. A shorter collection interval generally signifies that the corporate collects payments effectively, contributing to a gentle cash move.